Here are 4 tips for today's trading. This will help you decide where you should invest and what to look for:

1) Pharmaceutical Deal

Shares in the UK pharmaceutical giant Shire (SHPG) dropped like a rock this morning -- down by as much as 29% -- following indications that US drugmaker AbbVie (ABBV) may ditch its $55 billion takeover of the company.

AbbVie said Tuesday that its board of directors is taking another look at the deal after the Obama Administration introduced measures last month to make it harder for American companies to reduce their tax bills by merging with foreign firms and moving abroad.

2) Ready for Earnings

: Investors are preparing for a swing of big earnings announcements Wednesday.

Bank of America (BAC) and BlackRock (BLK) will report quarterly results before the opening bell. American Express (AXP), eBay (EBAY, Tech30) and Netflix (NFLX, Tech30) will report after the close.

Markets are also ready to react to Intel (INTC, Tech30) earnings. Shares are rising by about 1.5% premarket after the company reported a 12% jump in quarterly income compared to last year.

3) Softening Markets

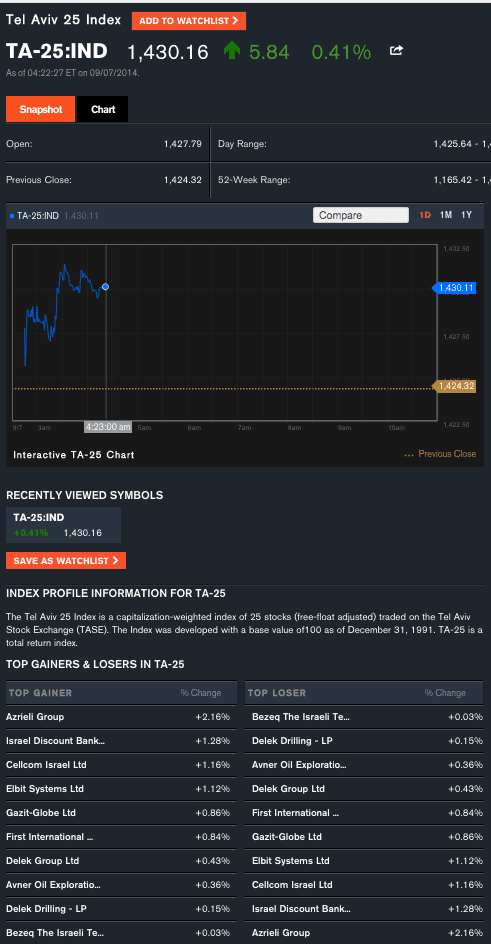

US stock futures were relatively calm, with the indexes not straying far from Tuesday's closing levels.

US stocks posted mixed results over the previous session. The Dow Jones industrial average slid slightly into the red, losing about 6 points. But the S&P 500 rose 0.2% and the Nasdaq ended the day 0.3% higher.

Markets seem to be mellowing out after taking a sharp dive between Thursday and Monday.

On the other side of the pond, European markets were lower. Asian markets mostly closed with gains.

4) Economic Agenda

The US Census Bureau will report monthly retail sales at 8:30am Eastern Time.

At 2:00pm, the Federal Reserve will release its Beige Book, which is a compilation of anecdotal information about the state of the US economy.

Talk to us to get get FREE signals and start earning now:

Other top stories:

Asia Stocks and Dollar Stabilize

Follow us and SHARE this story on Facebook/Twitter: