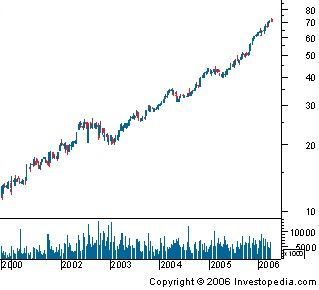

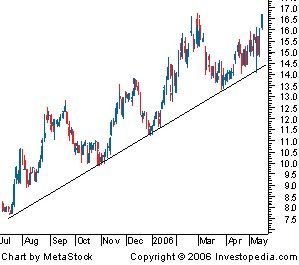

One of the most important concepts in technical analysis is that of trend. The meaning in finance isn't all that different from the general definition of the term - a trend is really nothing more than the general direction in which a security or market is headed. Take a look at the chart below:

Figure 1

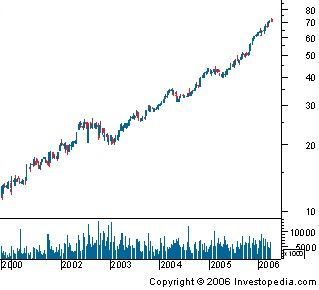

It isn't hard to see that the trend in Figure 1 is up. However, it's not always this easy to see a trend:

Figure 2

There are lots of ups and downs in this chart, but there isn't a clear indication of which direction this security is headed.

A More Formal Definition

Unfortunately, trends are not always easy to see. In other words, defining a trend goes well beyond the obvious. In any given chart, you will probably notice that prices do not tend to move in a straight line in any direction, but rather in a series of highs and lows. In technical analysis, it is the movement of the highs and lows that constitutes a trend. For example, an uptrend is classified as a series of higher highs and higher lows, while a downtrend is one of lower lows and lower highs.

Types of Trend

There are two types of trend:

Sideways/Horizontal Trends As the names imply, when each successive peak and trough is higher, it's referred to as an upward trend. If the peaks and troughs are getting lower, it's a downtrend. When there is little movement up or down in the peaks and troughs, it's a sideways or horizontal trend. If you want to get really technical, you might even say that a sideways trend is actually not a trend on its own, but a lack of a well-defined trend in either direction. In any case, the market can really only trend in these three ways: up, down or nowhere.

Trend Lengths

Along with these three trend directions, there are three trend classifications. A trend of any direction can be classified as a long-term trend, intermediate trend or a short-term trend. In terms of the stock market, a major trend is generally categorized as one lasting longer than a year. An intermediate trend is considered to last between one and three months and a near-term trend is anything less than a month. A long-term trend is composed of several intermediate trends, which often move against the direction of the major trend. If the major trend is upward and there is a downward correction in price movement followed by a continuation of the uptrend, the correction is considered to be an intermediate trend. The short-term trends are components of both major and intermediate trends. Take a look a Figure 3 to get a sense of how these three trend lengths might look.

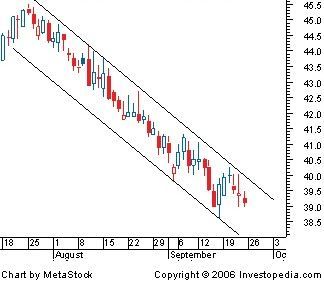

Figure 3

When analyzing trends, it is important that the chart is constructed to best reflect the type of trend being analyzed. To help identify long-term trends, weekly charts or daily charts spanning a five-year period are used by chartists to get a better idea of the long-term trend. Daily data charts are best used when analyzing both intermediate and short-term trends. It is also important to remember that the longer the trend, the more important it is; for example, a one-month trend is not as significant as a five-year trend.

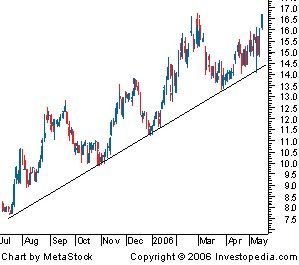

Trendlines

A trendline is a simple charting technique that adds a line to a chart to represent the trend in the market or a stock. Drawing a trendline is as simple as drawing a straight line that follows a general trend. These lines are used to clearly show the trend and are also used in the identification of trend reversals. As you can see in Figure 4, an upward trendline is drawn at the lows of an upward trend. This line represents the support the stock has every time it moves from a high to a low. Notice how the price is propped up by this support. This type of trendline helps traders to anticipate the point at which a stock's price will begin moving upwards again. Similarly, a downward trendline is drawn at the highs of the downward trend. This line represents the resistance level that a stock faces every time the price moves from a low to a high.

Figure 4

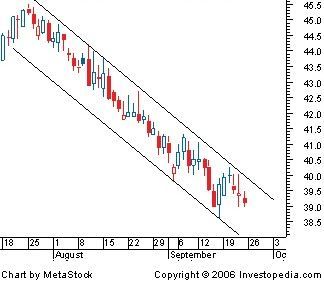

Channels

A channel, or channel lines, is the addition of two parallel trendlines that act as strong areas of support and resistance. The upper trendline connects a series of highs, while the lower trendline connects a series of lows. A channel can slope upward, downward or sideways but, regardless of the direction, the interpretation remains the same. Traders will expect a given security to trade between the two levels of support and resistance until it breaks beyond one of the levels, in which case traders can expect a sharp move in the direction of the break. Along with clearly displaying the trend, channels are mainly used to illustrate important areas of support and resistance.

Figure 5

Figure 5 illustrates a descending channel on a stock chart; the upper trendline has been placed on the highs and the lower trendline is on the lows. The price has bounced off of these lines several times, and has remained range-bound for several months. As long as the price does not fall below the lower line or move beyond the upper resistance, the range-bound downtrend is expected to continue.

The Importance of Trend

It is important to be able to understand and identify trends so that you can trade with rather than against them. Two important sayings in technical analysis are "the trend is your friend" and "don't buck the trend," illustrating how important trend analysis is for technical traders.

Ask us about our FREE financial advice program:

Other Top Stories:

Technical Analysis Lesson 1 - Introduction

Technical Analysis Lesson 2 - The Basic Assumptions

How I Made Over $30,000 a Year by Investing in Binary Options

Follow us and SHARE this story on Facebook:

![]()