Get ready for a busy Wednesday.

U.S. stock futures are ticking higher after China released GDP figures, and Greece prepares to hold crucial vote on its latest bailout.

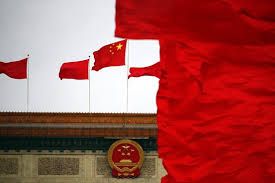

1) China GDP

The world's second largest economy grew at a slightly faster pace than expected in the second quarter. Official figures out Wednesday put GDP at 7%, in line with the previous quarter, and Beijing's growth target for the full year.

Growth has slowed considerably from the breakneck pace of previous years, and it's expected to drop further through to 2016.

The positive quarterly numbers didn't stop falls on China's stock markets. The Shanghai Composite resumed its recent slide to close down 3%.

2) Greece votes

Greek lawmakers will vote to ratify tough economic reforms on Wednesday needed to secure Europe's latest offer of $96 billion to bailout the country.

But the International Monetary Fund, one of Greece's major creditors, has warned on the viability of the bailout. The IMF said Tuesday that the country's debt has become "highly unsustainable," and it needs more debt relief than Europe has so far been willing to consider.

3) Oil dips

Crude prices have regained some poise, slipping 0.5% to just below $53 a barrel in electronic trading, after a landmark deal on Iran's nuclear program sealed Tuesday prompted a turbulent session for oil.

4) Earnings and economics

It's a busy day for earnings. Bank of America (BAC) and Delta (DAL) will report ahead of the open along with Blackrock (AOCXX).

Computer chip maker Intel (INTC, Tech30) and Netflix (NFLX, Tech30) report quarterly earnings after the close. Netflix (NFLX, Tech30) shares were rising 2.4% premarket.

On the economic front, the Bureau of Labor Statistics updates its producer price index with June numbers at 8:30 a.m. ET. Numbers on June industrial production will also release at 8:30 a.m. ET.

Federal Reserve chair Janet Yellen will deliver her semi-annual testimony before Congress at 10:00 a.m. ET.

Ask us about our FREE financial advice program: ![]()

Other Top Stories:

Technical Analysis Lesson 1 - Introduction

How I Made Over $30,000 a Year by Investing in Binary Options

Follow us and SHARE this story on Facebook: ![]()