(may 24, 2014) The next currency crisis in Asia is brewing up. You are wondering from where! but it is simply from Ukraine/Russia/Crimea. The Russia/Ukraine relationship is not good as it is of now and this is a political as well as an economic crisis brewing up in Asia and which might spread to other close economies. The sanctions that are running after Russia are coming from major economies and may mean a lot for Russia and regional economies that trade with this country. No one imagined this crisis will reach this level and efforts to solve the crisis are bear no quantitative fruits.

.

The better part of Asian countries currencies are reported to remain below their expected levels on Asian Forex Exchange markets since the beginning of the year. Their situations seem to worsen when the new geopolitical crisis showed up in mid March. Global business and trades are not immune to a smell of political crisis and multinational corporations are being punished for no good reason.

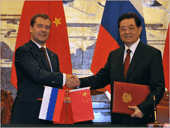

Geopolitical crisis raise interest not only from affected countries but also from those countries that seem to join in as aliens. For example, the European Union and the U.S. are behaving as aliens of Ukraine towards Russia and the whole issue becomes a matrix, which is hard to understand but books such as financial reports can tell. The aliens offer effective support to one country and try to remove comparative support from the other country, which they do not seem to favor.

Although there was no immediate shift in the Asian currencies relationships with the U.S. dollar during and at the beginning of the crisis, the effect can now be seen because economies close to Russia and Ukraine have begun noticing a steady fall on their currencies against the dollar since March 2014; something that has not been seen since 1997.

As much as independent or closed economies don’t care about geopolitical crisis, nations/countries relationships do not only zero into state or government deals. There are multinational businesses, which conduct their business with strategies that do not take into account governmental relationships. Although such companies can conduct their business in crisis countries, the pain comes when they want to exchange local currencies to USD or Euro. This exchange will not favor them and their general business health in such a particular case is at mercies of dust settling down.

Although developed and developing Asian economies give their credit to the natural resources they have, some countries are living up into waste because of crises despite the natural and valuable resources they possess.

A slight financial market change in Asia is thought to shake some economies to the extent of notwithstanding collaborations such as coming together to create regional economies. This vulnerability is usually a characteristic of developing countries, which strain with governmental development loans from World Bank. It is an economic pain to have a loan and trade in a region with some element of political interests because you do not know what significant developments will accrue during such a tension.

Asia has had a fair share of economic crisis and the pain is felt to date because the 1997 global economic crisis is better labeled Asian financial or economic crisis because this continent was hit the most. Countries and traders in this region are worried about the development in Russia’s relationship with other countries of the world especially the major economies. Keeping a watch in the financial market can help explain economic development in Asia and close economies as the Crimea issue unfolds. We hope the tables will turn and the strict USD dollars will exchange fairly over time.