Tessie's Review - 16/10

- Donald Herison

- English

- TESTIMONIALS

- Hits: 1804

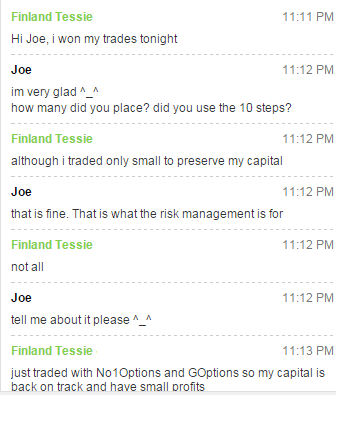

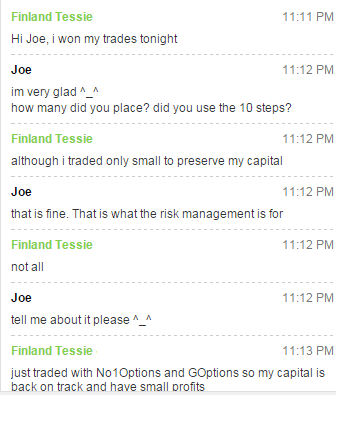

Tessie from Finland was happy from our service.

Thank you Tessie for your good review.

To join our community please click here: ![]()

Tessie from Finland was happy from our service.

Thank you Tessie for your good review.

To join our community please click here: ![]()

All eyes are on Chinese shoppers and gamblers on Friday.

As the world's second biggest economy slows, Chinese are becoming more cautious about spending on luxury brands.

Here are 4 tips for today's trading. This will help you decide where you should invest and what to look for:

1. Chinese cut down on luxury shopping

Hugo Boss (BOSSY) is the latest company to feel the pinch from the slump in China. The German fashion brand is tanking 10% in London, after cutting its sales earnings outlook due to tougher conditions in Asia.

Burberry (BBRYF) and Louis Vuitton (LVMHF) both blamed China for weaker sales earlier this week.

2. Stock market movers

Yum Brands, Nestle, Wynn Resorts: Yum Brands (YUM) stock rose 2.2% in after-hours trading.

Wynn Resorts (WYNN), the casino and hotels operator, is down 8.5% premarket, after its Macau division reported a net revenue decline of nearly 40% Thursday.

Nestle (NSRGF) has cut its outlook for this year, pushing its shares down 2%. The company was hit by a temporary ban on one of its most popular products, Maggi noodles, in India after reports of lead contamination. Nestle disputed the findings, and won an appeal, but the company said the affair had a "material impact."

3. Earnings and economics

Companies including General Electric (GE) and Honeywell (HON) will report quarterly earnings before the opening bell rings.

At 10 a.m. ET, the University of Michigan will release its October consumer sentiment index.

U.S. manufacturing and industrial production data will be published at 8:15 a.m. ET, giving an insight into the health of the economy.

Investors will watch the data to get a sense of how likely is it the Federal Reserve could still raise interest rates this year. The Fed didn't raise rates in September and a rate hike in October looks very unlikely. But some Fed officials still want a rate hike in 2015.

Final data confirmed consumer prices across the eurozone fell by 0.1% in September. It's the first time Europe has slipped into deflation since March, when the European Central Bank began pumping 60 billion euros ($67 billion) a month into the region's markets in an attempt to boost prices and economic activity.

4. Market overview and recap

Most world markets are gaining Friday. European markets are all up in early trading. Asian markets ended the week with a positive session.

U.S. stocks closed over 1% higher Thursday. The Dow Jones industrial average rose 1.3%, the S&P 500 was up 1.8% and the Nasdaq climbed 1.5%.

Ask us about our FREE financial advice program: ![]()

Other Top Stories:

Technical Analysis Lesson 1 - Introduction

How I Made Over $30,000 a Year by Investing in Binary Options

Follow us and SHARE this story on Facebook: ![]()

What is it? Financial confidence is a leading indicator of consumer spending, which accounts for a majority of overall economic activity.

When? At 10:00am Eastern Time.

Trading Tip: If the actual number is higher than the forecast, you can expect the USD to rise.

Ask us about our FREE financial advice program: ![]()

Other Top Stories:

Technical Analysis Lesson 1 - Introduction

How I Made Over $30,000 a Year by Investing in Binary Options

Follow us and SHARE this story on Facebook: ![]()

What is it? It's a leading indicator of economic health - manufacturers are quickly affected by market conditions, and changes in their sales can be an early signal of future activity such as spending, hiring, and investment.

When? At 8:30am Eastern Time.

Trading Tip: If the actual number is higher than the forecast, you can expect the CAD to rise.

Ask us about our FREE financial advice program: ![]()

Other Top Stories:

Technical Analysis Lesson 1 - Introduction

How I Made Over $30,000 a Year by Investing in Binary Options

Follow us and SHARE this story on Facebook: ![]()