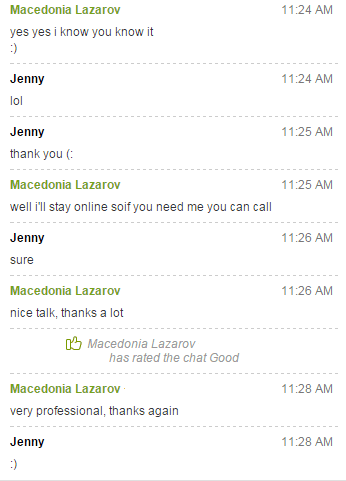

Lazarov's Review - 19/10

- Donald Herison

- English

- TESTIMONIALS

- Hits: 1603

Lazarov from Macedonia was happy from our representative Jenny.

We wish to thank him for his good customer review.

To join our community please click here:![]()

Lazarov from Macedonia was happy from our representative Jenny.

We wish to thank him for his good customer review.

To join our community please click here:![]()

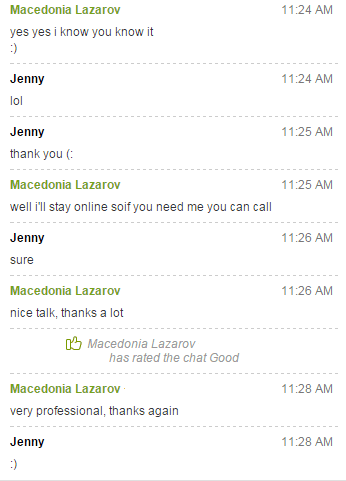

A new trading week kicks off soon.

Investors are keeping an eye on China's economy, commodities and quarterly earnings.

Here are 4 tips for today's trading. This will help you decide where you should invest and what to look for:

1. Chinese GDP

China's economy has posted its slowest growth since the financial crisis, with gross domestic product expanding by 6.9% in the third quarter compared to the same period last year, according to official data.

The growth was slightly better than economists expected, but it marks a deceleration from the 7% expansion seen in the first half of the year.

Chinese government officials are aiming for annual growth of around 7%.

Meanwhile, some observers are concerned the official data is painting an unrealistically rosy picture.

"The GDP figure of 6.9% has restored fresh debates over the accuracy of China's growth statistics with fears that the GDP growth is even lower than what the official statistics dictate," said research analyst Lukman Otunuga at online broker FXTM.

2. Commodities slump

Global oil prices are slumping by about 1% and prices for precious metals and industrial metals are all declining.

As a result, shares in mining companies are taking a hit, especially in London.

Commodity prices tend to drop based on concerns about a slowing Chinese economy, since a slowdown in the world's second-biggest economy means lower global demand for construction products, shiny jewelry and fuel, among other things.

3. Earnings

Morgan Stanley (MS), Halliburton (HAL) and Hasbro (HAS) are some of the companies posting quarterly earnings before the markets open.

Then after trading finishes for the day, IBM (IBM, Tech30), Six Flags (SIX) and Sonic (SAH) will report.

4. Stock market overview

U.S. stock futures are not making any big moves ahead of the open. They're sitting around the levels where they closed on Friday.

European markets are mostly edging higher in early trading, while Asian markets ended with mixed results.

Last week the Dow Jones industrial average posted its third week of gains. It's risen by 5.7% since the start of October.

The S&P 500 and Nasdaq have also made impressive gains over the same period, up 5.9% and 5.8%, respectively.

Ask us about our FREE financial advice program: ![]()

Other Top Stories:

Technical Analysis Lesson 1 - Introduction

How I Made Over $30,000 a Year by Investing in Binary Options

Follow us and SHARE this story on Facebook: ![]()

What is it? It's a detailed record of the RBA Reserve Bank Board's most recent meeting, providing in-depth insights into the economic conditions that influenced their decision on where to set interest rates.

When? At 8:30am Eastern Time.

Trading Tip: If the announcement will hint towards higher interest rates, you can expect the AUD to rise.

Ask us about our FREE financial advice program: ![]()

Other Top Stories:

Technical Analysis Lesson 1 - Introduction

How I Made Over $30,000 a Year by Investing in Binary Options

Follow us and SHARE this story on Facebook: ![]()

1. U.S. stocks opened higher on Friday, a day after hitting an 8-week high, underpinned by better-than-expected third-quarter earnings from industrial majors General Electric (N:GE) and Honeywell.

The Dow Jones industrial average (DJI) rose 30.06 points, or 0.18 percent, to 17,171.81, the S&P 500 (SPX) gained 3.24 points, or 0.16 percent, to 2,027.1 and the Nasdaq composite (IXIC) added 3.99 points, or 0.08 percent, to 4,874.09.

2. The U.S. dollar was higher against its Canadian counterpart on Friday, pulling away from a three-month low after the release of better-than-expected economic reports from both Canada and the U.S.

USD/CAD hit 1.2931 during early U.S. trade, the session high; the pair subsequently consolidated at 1.2905, gaining 0.37%.

The pair was likely to find support at 1.2719, the low of July 15 and resistance at 1.3039, Wednesday's high.

3. Oil prices rose on Friday, snapping a week-long decline as investors closed positions at the end of a volatile week that saw prices slide nearly 10 percent on renewed signs a global supply glut was here to stay.

Brent crude's new front-month December contract (LCOc1) was up 60 cents at $50.33 a barrel at 1338 GMT. November Brent expired at $48.71 on Thursday, down 44 cents on the day.

U.S. crude's front-month November contract (CLc1) traded 99 cents higher, or 2.13 percent, at $47.37 a barrel.

4. The dollar remained broadly higher against the other major currencies in quiet trade on Friday, as the previous session's upbeat U.S. data continued to support demand for the greenback and as investors eyed the release of additional U.S. economic reports later in the day.

The dollar was higher against the yen, with USD/JPY rising 0.16% to 119.08.

5. U.S. industrial production fell for a second straight month in September on renewed weakness in oil and gas drilling, the latest indication that the economy lost momentum in the third quarter.

Industrial output slipped 0.2 percent after a revised 0.1 percent dip in August, the Federal Reserve said on Friday.

Economists polled by Reuters had forecast industrial production slipping 0.2 percent last month after a previously reported 0.4 percent decline in August.

Industrial production rose at an annual rate of 1.8 percent in the third quarter.

Ask us about our FREE financial advice program: ![]()

Other Top Stories:

Technical Analysis Lesson 1 - Introduction

How I Made Over $30,000 a Year by Investing in Binary Options

Follow us and SHARE this story on Facebook: ![]()