Maria's Review - 30/10

- Donald Herison

- English

- TESTIMONIALS

- Hits: 1897

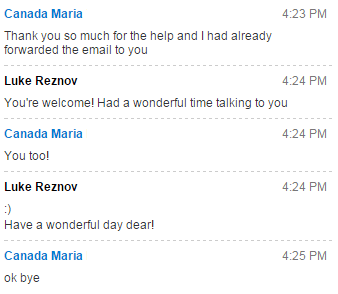

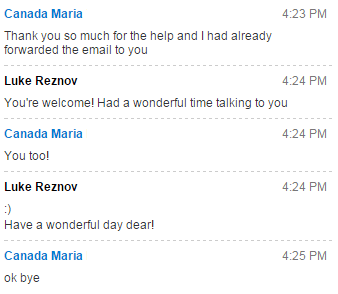

Maria from Canada had a good Chat with our agent Luke.

We thank Maria for the kind words.

To join our community please click here:![]()

Maria from Canada had a good Chat with our agent Luke.

We thank Maria for the kind words.

To join our community please click here:![]()

Welcome to the final trading day of October.

Here are 4 tips for today's trading. This will help you decide where you should invest and what to look for:

1. Stock market overview

U.S. futures are solid ahead of the open, indicating stocks may edge higher when the trading bell rings.

European markets are mostly positive in early trading, though the gains are small.

Asian markets generally closed the week with some losses. China's announcement that it would abolish its "one-child" policy didn't give the markets a lift. The change isn't expected to help China's faltering economy for years.

2. Market movers

First Solar, Expedia, Genworth: Investors in First Solar (FSLR) are in for a treat after the solar panel manufacturer released better-than-expected earnings on Thursday evening. Shares are rising by about 11% premarket.

Expedia (EXPE) stock is also rising by about 6% in extended trading after the travel website company unveiled earnings that beat Wall Street forecasts.

But investors were unimpressed with the latest quarterly report from financial services company Genworth (GNW). Shares dropped by about 11% in extended trading.

3. Earnings

Noteworthy companies reporting this morning include Exxon Mobil (XOM), Phillips 66 (PSX), CVS Health (CVS) and Chevron (CVX)

Beer brewing giant Anheuser-Busch InBev (AHBIF) is also posting quarterly results and could provide an update about its planned takeover of SABMiller (SBMRY).

4. Economics

Japan's central bank decided to hold its fire on more economic stimulus after a policy meeting wrapped up Friday. Some experts had expected the government to act, as the latest figures showed the economy shrank by 0.3% in the second quarter.

In the U.S., the Bureau of Economic Analysis will post its September report on personal income and spending at 8:30 a.m. ET.

The University of Michigan will give a final update to October's consumer sentiment index at 10 a.m.

Ask us about our FREE financial advice program: ![]()

Other Top Stories:

Technical Analysis Lesson 1 - Introduction

How I Made Over $30,000 a Year by Investing in Binary Options

Follow us and SHARE this story on Facebook: ![]()

What is it? It's a leading indicator of consumer inflation - when businesses pay more for labor the higher costs are usually passed on to the consumer.

When? At 8:30am Eastern Time.

Trading Tip: If the actual number is higher than the forecast, you can expect the USD to rise.

Ask us about our FREE financial advice program: ![]()

Other Top Stories:

Technical Analysis Lesson 1 - Introduction

How I Made Over $30,000 a Year by Investing in Binary Options

Follow us and SHARE this story on Facebook: ![]()

What is it? It's the broadest measure of economic activity and the primary gauge of the economy's health.

When? At 8:30am Eastern Time.

Trading Tip: If the actual number is higher than the forecast, you can expect the CAD to rise.

Ask us about our FREE financial advice program: ![]()

Other Top Stories:

Technical Analysis Lesson 1 - Introduction

How I Made Over $30,000 a Year by Investing in Binary Options

Follow us and SHARE this story on Facebook: ![]()