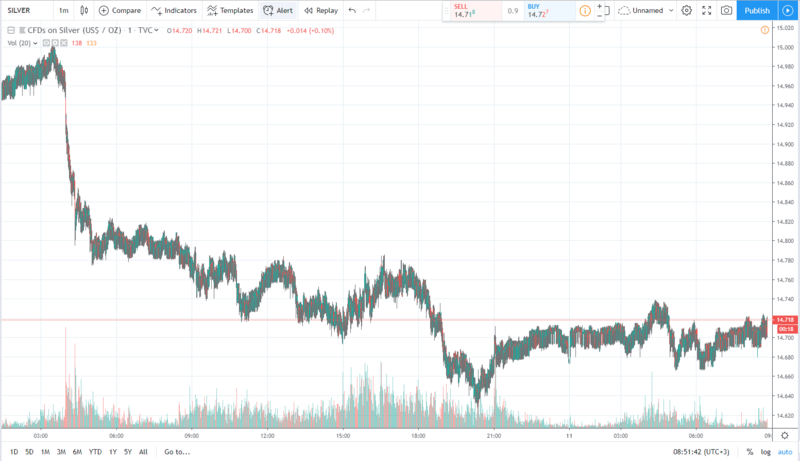

It seems that there is no hope left for silver. The precious metal has been sliding for so long that it seems that it is going to become that very example of an asset that slid from a high position and will never come back there. It has been months since silver was at its high position of higher-than-$15-per-ounce and no matter how good the circumstance for recovery are silver doesn’t seem to be able to breach that level of pricing. And the fact that all of the bullish tries were cut out by bears even in today’s trading is really getting us worried.

Silver has been always going together with the price for gold. And gold is tied to the USD performance against the greenback. And so the weaker dollar is – the more expensive silver is supposed to get. But for some reason surges in silver price are so weak that it is hard to say whether the market is going to recover at all at this point.

It is very plausible that $15 per-ounce level is not going to be breached by silver for a very long time. And when it does break it we are looking at a huge possibility to see gains. Use your trading signals to see the breaking point of the metal.